Philippines

Hiring offshore could be an effective human resource strategy but it comes with its own complicated set of problems. With Satellite Teams, you can hire and manage the top caliber talent the Philippines has to offer with total ease and confidence–all in one single platform.

Global Expansion Has Never Been This Easy

Satellite Teams is your #1 guide to hiring the top remote rockstars in the Philippines under the country’s comprehensive local labor laws, regulatory compliances, payroll, taxes, benefits management, and more.

What’s The Talent Like In The Philippines?

The Workforce

The Philippines has a large pool of skilled workers known for excelling in almost any field. But the workforce is most successful in the areas of IT, customer service, data analysis, accounting, and engineering.

Language Proficiency

The country has a high English proficiency rate, with many Filipinos being fluent in English. 95% of the Philippine’s workforce is bilingual, making communication with US-based clients and partners easier.

Competitiveness

With a high literacy rate of 97%, the Philippines produces a large number of graduates every year. Partnered with strong work ethic, resilience, and technical skills, Filipino workers are an attractive option for foreign companies looking to hire global talent.

Benefits of Hiring Talent From The Philippines

The Philippines is one of the top sources of skilled remote workers for companies around the world. But what is it about the country that attracts foreign businesses?

Outsourcing Success

Known as the BPO capital of the world, recently generating $29.1 billion in revenue, the Philippines is not new to outsourcing. And as various global talent hiring models arise, the country continues to be the top destination for qualified human capital.

Cost-Effectiveness

For foreign businesses looking to reduce cost, the Philippines is a great place to start, as it has a relatively low cost of labor. In contrast, the current minimum wage in the country ranges from Php 533 to Php 570, which is less than $11.

Government Incentives

The Philippine government offers various incentives and programs to attract foreign investments. This includes advantages such as tax breaks, streamlined procedures for starting a business, and economic zones.

Most Hired Roles from Philippines

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Data

Analyst

J. Noval

Detail-oriented data analyst who excels in collecting, manipulating, and assessing large datasets using statistical analysis.

Accounting

Specialist

C. Dela Cruz

Qualified accounting professional experienced in recording financial transactions, reconciling accounts, preparing financial reports, and more.

Systems Administrator

B. Parungao

Focused systems administrator with a proven record of installing, configuring, updating, and maintaining hardware of computer systems and networks within an organization.

Data Analyst

J. Noval

Detail-oriented data analyst who excels in collecting, manipulating, and assessing large datasets using statistical analysis.

Accounting

Specialist

C. Dela Cruz

Qualified accounting professional experienced in recording financial transactions, reconciling accounts, preparing financial reports, and more.

Systems

Administrator

B. Parungao

Focused systems administrator with a proven record of installing, configuring, updating, and maintaining hardware of computer systems and networks within an organization.

What It Takes To Hire Global Talent in The Philippines

-

Minimum Wage

The minimum wage in the Philippines varies depending on the region and industry. As of 2021, the minimum wage ranges from PHP 533 to PHP 570 per day, or roughly PHP 12,855 to PHP 14,820 per month. -

Overtime Pay

For work done beyond the regular 8-hour workday or 40-hour workweek, employees in the Philippines are entitled to overtime pay, which is 125% of their regular hourly rate. -

13th Month Pay

All employees who have worked for at least one month in a year are entitled to receive a 13th month pay, which is equivalent to one-twelfth (1/12) of their total basic salary earned during the year. -

Social Security System (SSS)

The SSS is a government-mandated social insurance program that provides benefits such as retirement, disability, and death benefits. Both the employer and employee are required to contribute to the SSS. -

PhilHealth

PhilHealth is a national health insurance program in the Philippines that provides medical and health-related benefits. Both the employer and employee are required to contribute to PhilHealth. -

Pag-IBIG Fund

The Pag-IBIG Fund is a government-mandated savings program that provides housing and short-term loans, as well as other benefits. Both the employer and employee are required to contribute to the Pag-IBIG Fund.

- Corporate Income Tax: Employers in the Philippines are subject to a corporate income tax of 30% on their net income.

- Withholding Tax: Employers are required to withhold and remit to the Bureau of Internal Revenue (BIR) a percentage of their employees' compensation as income tax. The withholding tax rates vary depending on the employee's income and tax status.

- Personal Income Tax: Employees in the Philippines are required to pay personal income tax on their income, which is computed based on the tax rates and brackets set by the BIR. The personal income tax rates in the Philippines range from 0% to 35%.

- Withholding Tax: Employers are required to withhold and remit a portion of their employees' compensation as withholding tax on income. The withholding tax rates depend on the employee's compensation and tax status.

-

Service Incentive Leave

Employees who have worked for at least one year are entitled to an annual leave of at least five days with pay. The number of days may increase depending on the length of service of the employee. -

Emergency Leave

Employees are entitled to a special leave of up to seven days with pay for certain circumstances, such as marriage, death of a family member, and calamity. -

Sick Leave

Employees are entitled to a sick leave of at least five days with pay per year. This may be extended depending on the employee's medical condition. Maternity Leave Female employees are entitled to a maternity leave of 105 days with pay for normal delivery, and 120 days with pay for cesarean delivery. -

Paternity Leave

Male employees are entitled to a paternity leave of seven days with pay for the birth of their child. -

Solo Parent Leave

Solo parents who have worked for at least one year are entitled to a solo parent leave of seven working days with pay.

-

Just and Authorized Causes

Termination must be for a just or authorized cause, such as redundancy, retrenchment, closure of business, serious misconduct, or violation of company policies. -

Due Process

Employers must follow due process when terminating an employee, which includes giving the employee notice of the grounds for termination and an opportunity to be heard. -

Notice and Severance Pay

Employers must provide written notice of termination to the employee and the Department of Labor and Employment (DOLE) at least 30 days before the intended date of termination. Employees who are terminated for authorized causes are entitled to separation pay equivalent to one month's pay for every year of service. -

Payment of Final Wages and Benefits

Employers must pay the employee's final wages and benefits, including any unused vacation leave, sick leave, and other benefits, within the time period prescribed by law. -

Non-Discrimination

Employers must not terminate an employee on the basis of age, sex, religion, race, or any other discriminatory ground. -

Retaliatory Termination

Employers must not terminate an employee who has filed a complaint or taken legal action against the employer for violation of labor laws or for engaging in union activities.

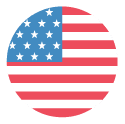

Compare Costs of

Hiring in The Philippines

Philippines

Graphic Designer

All-inclusive Monthly Rate

$1500-$2500

United States

Graphic Designer

All-inclusive Monthly Rate

$5000-$7000

Get The Best Talent The Philippines Has To Offer

Find out how you get access to the Philippines’ top talent without all the regulatory and compliance headaches. Reach out to us today!